Good trading requires a good understanding behind the maths related to how money is exposed to the markets. There is a misconception that the percentage lost is equal to the percentage recovery, as many new traders believe that their losses can be easily recovered.

At low drawdown levels (between 1% and 10%), the recovery needed is approximately equal to the drawdown. However, when trading losses become too large, the recovery departs away from the 1 : 1 straight line nature needed to break even. This poses a problem, as losses can get out of hand to the detriment of your trading account.

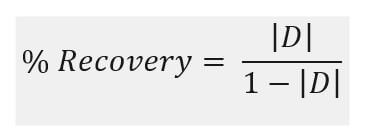

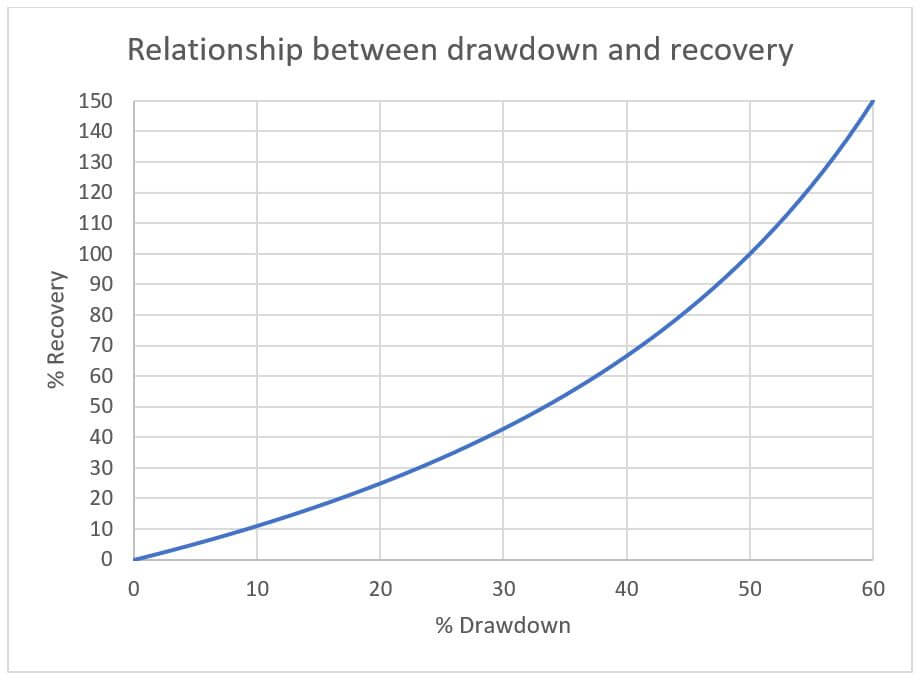

Why is this the case? The higher the drawdown, the less account capital there is to return to break even. Your money has less “magnitude” and thus has to “work harder” to return to the original capital. The asymmetric relationship between drawdown D and the percentage recovery to break even is described by the following formula:

For small values of drawdown D, the relationship is approximately linear. As losses increase, the % recovery departs further away from the drawdown (shown in graph below). At 10% drawdown, the percentage recovery needed is 11%; at 50% drawdown, the percentage recovery is 100%:

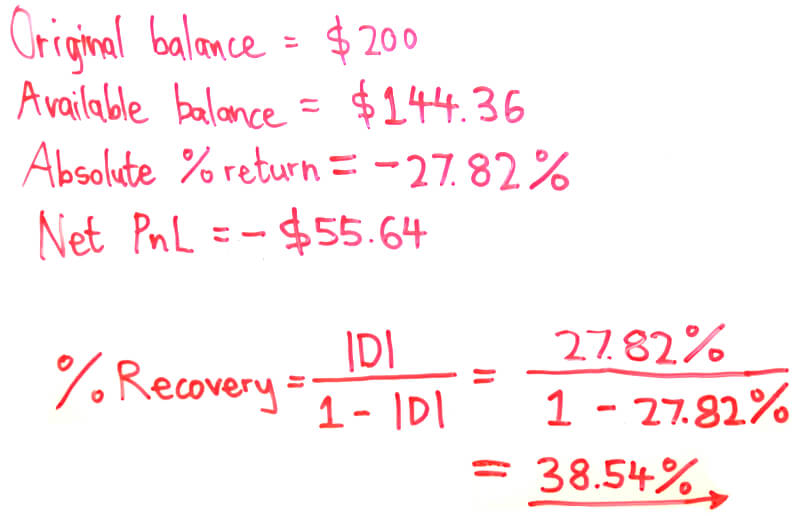

Let’s test this relationship with the following example:

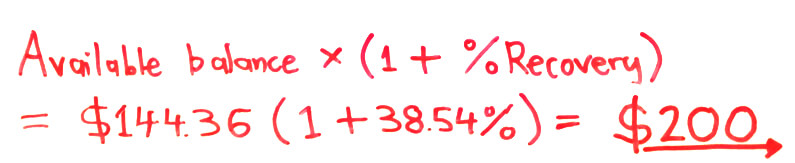

A drawdown of 27.82% requires a significant recovery of 38.54% to return to the original deposit of $200. The recovery value can be sanity checked by multiplying it to the available balance to return the original balance:

The bottom line: keep your losses to a minimum and avoid large losses as much as possible. Do your best to avoid the drawdowns from running away out of control.